For many older Americans, retirement is shaping up to not really be retirement at all.

In addition to those who continue working full-time well into their 60s and beyond, many who do leave 40-hour workweeks behind end up taking on part-time work even if it wasn’t part of their initial retirement plan.

“We’re seeing a trend of people retiring from a long-term career … and a while later deciding they want a part-time job,” said certified financial planner Julie Virta, a senior financial advisor with Vanguard.

“I still see people working at age 70, 71 or 72,” Virta said. “It brings them a sense of value that they had in their long-time professional career.”

More than half (54.7 percent) of people age 60 to 64 were working at least part-time in 2017, according to the Bureau of Labor Statistics. In the 65-to-69 crowd, nearly a third (31.2 percent) were in the work force last year.

If you find yourself among those who return to work for any number of reasons — i.e., personal fulfillment, financial necessity — it’s important to be aware of the impact that the extra income could have on other areas of your financial life.

“If you choose to go back to work, there are probably a whole bunch of reasons it makes sense,” said DeDe Jones, a certified financial planner and managing director at Innovative Financial. “You just should know what to expect.”

Effect on Social Security

If you tap Social Security before your full retirement age (as defined by the government) and are still working or return to work, your wage income could reduce your benefits.

While delaying Social Security for as long as possible means a higher monthly check, many people take it as soon as they can — at age 62 — or soon thereafter.

If you do start getting those monthly checks early, there’s a limit on how much you can earn from working without your benefits being affected. For 2018 that cap is $17,040.

If you earn more than that, your benefits will be reduced by $1 for every $2 you earn over that threshold.

Then, when you reach full retirement age around age 66 or 67 — the exact age depends on your birth year — the money comes back to you in the form of a higher monthly check.

At that point, you also can earn as much as you want from working without it affecting your Social Security benefits.

Also, if you are one of those early takers who is working and you reach full retirement age during 2018, $1 gets deducted from your benefits for every $3 you earn above $45,360.

Beware Medicare Surcharges

In addition to more income potentially pushing you into a higher tax bracket, it also could trigger additional costs for Medicare.

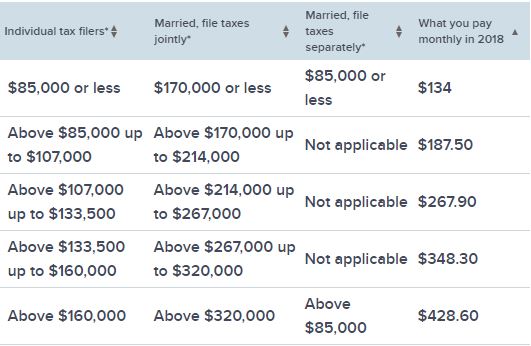

Basically, higher earners pay a surcharge for Medicare Part B (outpatient coverage) and Part D (prescription drugs). The extra charges start at income above $85,000 for individuals and $170,000 for married couples who file joint returns.

“If you’re a professional and you continue to work, you can be subject to the surcharges pretty easily,” Jones said. “It’s good to at least anticipate it if it’s unavoidable.”

Source: cnbc.com