As fiduciaries, it is our obligation to act in your best interest at all times. Our recommendations are not based on commissions or quotas. This allows our investment advisors to focus on your specific goals and manage the strategies and investments to attain them.

Individualized Portfolio Construction & Management

Your financial goals are unique, and your portfolio should reflect that. Our investment recommendations are customized to your specific goals, based on:

- Prevailing market conditions

- Your investment objectives

- Your time horizon

- Your attitudes towards risk

- Your financial situation

The economy isn’t static and your portfolio shouldn’t be either. Your partnership with AMG, a Registered Investment Advisor, doesn’t end after our first meeting. While you go about the business of saving for retirement, we’re consistently working in the background, monitoring your accounts. We meet with you throughout the year to review your portfolio, discuss any changes in your goals, and recommend adjustments to keep you on course.

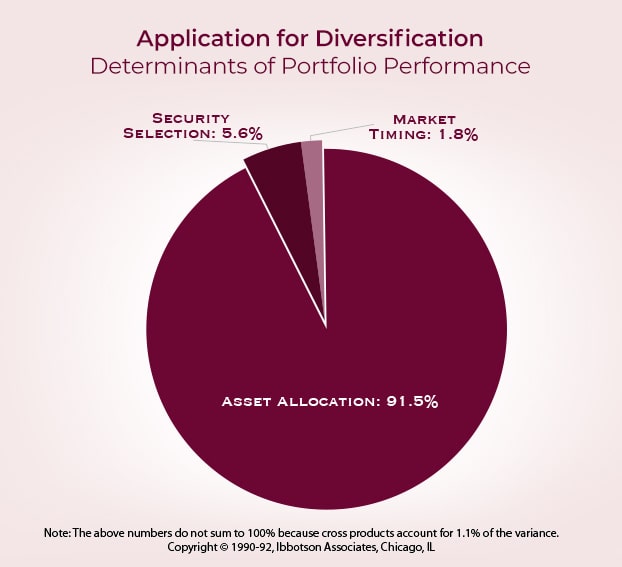

Modern Portfolio Theory

We follow a disciplined strategy based on the scientific foundation of Modern Portfolio Theory developed by Harry Markowitz in 1952. William Sharpe later expanded upon this theory and in 1990 its creators won the Noble Prize in Economic Science.

Modern Portfolio Theory is based on strategic diversification of investments across several different asset classes. Appropriate diversification among asset classes and market sectors provides investors with more consistent returns over time.